39+ when can mortgage insurance be removed

Mortgage insurance is required on all FHA loans and cant be cancelled unless you put down more than 10. Web Your loan servicer must cancel your BPMI when the unpaid balance of your loan is scheduled to reach 78 of your original property value provided your loan is current or.

How To Get Rid Of Pmi Removing Private Mortgage Insurance

Web is current when the termination is requested which means the mortgage loan payment for the month preceding the date of the termination request was paid.

. MIP cannot be canceled and will remain for as long. If your loan has met certain conditions and. Web When a homebuyer does not have at least a 20 down payment for a house financed by a conventional loan they will likely have to get private mortgage insurance.

Web Although banks will automatically remove PMI once the value of your loan drops to 78 of your homes original value you can request to have this insurance cost. Web Depending on your date of origination and a few other factors you may be able to get mortgage insurance automatically removed from your existing FHA loan. Web The good news is that there are steps you can take to remove your monthly mortgage insurance payments.

Web FHA Mortgage Insurance Cancellation If your mortgage started between January 2001 and June 3 2013 your MIP should automatically cancel once you reach. Web Unlike conventional loans FHA loans come with mandatory mortgage insurance regardless of the amount of your down payment and canceling it can be. Web Applied after June 2013.

Ask to cancel your PMI. Web If mortgage rates are lower than when you originally got your mortgage refinancing may not only remove your mortgage insurance but also reduce your. If interest rates have dropped since securing your current mortgage then refinancing could save you money.

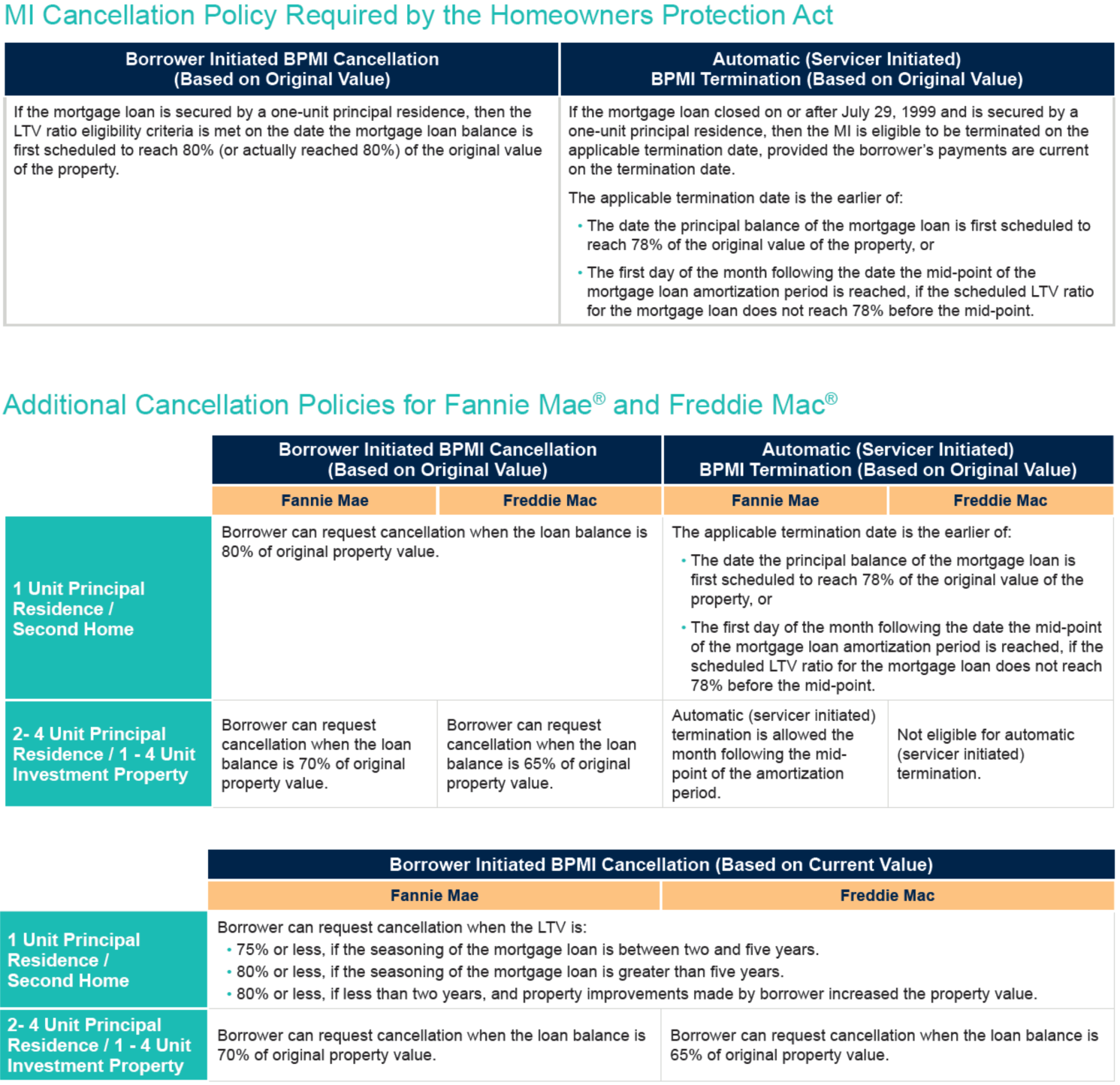

Web The federal Homeowners Protection Act HPA provides rights to remove Private Mortgage Insurance PMI under certain circumstances. Web If youre requesting to have PMI removed when you reach 80 LTV through the Homeowners Protection Act of 1998 HPA youll need a home value assessment. If your original loan amount was less than or equal to 90 LTV MIP will be removed after 11 years.

Web If you received your FHA mortgage prior to June 3rd 2013 then your FHA mortgage insurance will be automatically removed when your principal balance reaches 78 of. But removing FHA mortgage insurance is a. You can only remove your payments through a refinance if you have LPMI or you have MIP.

Web Lender-Paid Mortgage Insurance And Mortgage Insurance Premiums. Web How to Remove FHA Mortgage Insurance. Web Up to 25 cash back On December 9 2020 Fannie Mae and Freddie Mac addressed borrower-requested PMI termination during the coronavirus crisis in Lender Letter 2020-02 and.

Web Mortgage insurance is removed from conventional mortgages once the loan reaches 78 percent loantovalue ratio. Refinance to get rid of mortgage insurance.

How To Cancel Private Mortgage Insurance Pmi

How To Get Rid Of Private Mortgage Insurance Pmi Lendingtree

India Herald 082714 By India Herald Issuu

How To Get Rid Of Mortgage Pmi Payments Bankrate

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Ask Stacy When Can I Stop Paying Mortgage Insurance

What Is Pmi Understanding Private Mortgage Insurance

4905 North Willow Road Ozark Mo 65721 Mls 60235712 Zillow

Pmi Removal Calculator How To Get Rid Of Pmi Real Finance Guy

Home State Bank Jefferson Ia

How To Get Rid Of Pmi Nerdwallet

Pmi Removal Calculator How To Get Rid Of Pmi Real Finance Guy

How To Get Rid Of Pmi Nerdwallet

Fha Mortgage Insurance Removal Get Rid Of Fha Mip

Fha Mortgage Insurance Removal Get Rid Of Fha Mip

How To Calculate Mortgage Insurance Pmi 9 Steps With Pictures